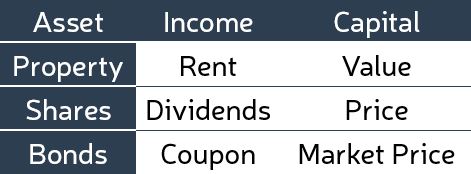

A typical investment is comprised of two money-making components: income and capital. In property, this reflects rent and value. Although both are important, the strongest gains are usually made on growth in value rather than growth in rental income.

Rental income makes an important contribution to property investment by offsetting ongoing costs like interest payments on the mortgage and other fees like property management, land rates and strata levies. This allows a property to be held long enough to make a significant capital gain.

Rental income makes an important contribution to property investment by offsetting ongoing costs like interest payments on the mortgage and other fees like property management, land rates and strata levies. This allows a property to be held long enough to make a significant capital gain.

So how can the income from property be maximised without compromising the ability for a property to grow in value? This question certainly came to the forefront as the resources industry slowed in growth, which caused high-yielding single industry towns to sharply lose both rental income and value.

It is important for an investor to be familiar with the differences between decent income-producing options and poor income-producing options. Consider some examples below:

Corporate letting provides an investor with a traditionally higher rental yield and accommodates travelling businesspeople. Depending on the contract agreement with the property manager, the investor can enter a short or medium term arrangement that still allows them the opportunity to market their property to investors and owner occupiers if so desired.

Defence Housing provides an investor with a consistent income stream as well as contributions to maintenance costs, however, over the period of the contract, if you decide to sell you’ll only be selling to an investor. This immediately limits you to an average of approximately 30 per cent of the purchaser market, and they’re the 30 per cent that purchase on numbers rather than emotion.

Dual key arrangements allow investors one title with two ‘independent’ income streams that typically return a higher yield in some states. The investor sacrifices this rental income for the likelihood their future purchaser will be an investor as these properties are typically purpose built for rental tenants. Particular challenges to value growth will be inefficient use of space, poor quality fixtures and fittings, oversupply of this niche property style and purchasing a property that is not suited to the demographic of the area.

Unique or point of difference properties aim to fill a potential under-supply of property that perfectly suits the local demographic. Examples could include 1 bedroom plus study apartments near a university or city where the study could be used as an extra sleeping space to reduce the rental burden on the tenant or to accommodate family guests of a young professional couple.

There are many more examples of unique ways to increase rental income but the prospective investor must ensure that they do not pursue this to the detriment of realising maximum capital growth over the medium and long term. Know the good and the bad.

Posted by Luke Graham